Collier Community Assistance Program FAQs

How is the ARP funded?

Congress passed the American Rescue Plan Act of 2021 (ARP), which was signed into law on March 11, 2021. Collier County entered into an agreement with the United States Treasury Department (Treasury) for a grant to execute and implement ARP, pursuant to the Coronavirus State and Local Fiscal Recovery Fund (SLRF), Section 603 (c) of the Social Security Act.

Is funding first-come, first-served?

Funding is allocated on a first come, first-qualified basis to those who meet the eligibility criteria and submit completed documents for approval. Financial assistance will be given to qualified applicants until relief funds are exhausted. Priority will be given to those at 50% average median income (AMI) and below.

Who can apply?

Individuals and families who have experienced unemployment, reduction of income, significantly increased expenses, or other financial hardship during or due directly or indirectly to the COVID-19 outbreak and need financial assistance paying rent or mortgage. This does not mean an applicant had to have contracted COVID to be eligible.

When can I apply?

The Coronavirus Local Fiscal Recovery Act’s American Rescue Plan Assistance Program (ARP) will re-open at 12 p.m. (noon) on Monday, March 4. A very limited number of applications will be accepted during the reopening. The portal will close on Friday, March 15, at midnight. Applications must be submitted before 11:59 p.m. on March 22.

How do I apply?

You can apply online or by scheduling an appointment at our office located at Court Plaza, 2671 Airport Pulling Road South in Naples. To schedule an in-person appointment, please call 239-450-2114. Please remember to save your password and case number in a secure location. You will need this login information to come back and check your status. You can always apply at any Collier County Public Library using their equipment if you do not have access to the internet or a computer in your home.

How is a household defined?

An applicant applies for the household. A household is defined as all persons living under one roof.

Do I have to repay the ARP funds?

No. The ARP assistance does not have to be paid back. However, fund distribution is reported to the IRS for landlords or if paid to tenant directly.

What is the CCAP (Collier County Assistance Program)?

ARP is allotted for renters whose AMI does not exceed 140%, Homeowners with mortgages and AMIs that also do not exceed 140% may also apply for ARP assistance. Both renters and homeowners may receive assistance with arrearage or future mortgage, rent and utility payments. To qualify, households must meet the income AMI range and have a documented mortgage, rent or utility obligation to pay.

The ARP program has a maximum award amount of $25,000.

All persons that experienced financial hardship since the onset of the coronavirus outbreak and total gross income falls within the limits in the table below are encouraged to apply.

**Please refer to the income chart below.**

| County (Metro) | Income Category |

Income Limit by Number of Persons in Household | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||

| Collier County

(Naples-Immokalee-Marco Island MSA) Median: $104,300 |

30% AMI | $21,950 | $25,050 | $28,200 | $31,300 | $36,580 | $41,960 | $47,340 | $52,720 | Refer to HUD | Refer to HUD |

| 50% AMI | $36,550 | $41,750 | $46,950 | $52,150 | $56,350 | $60,500 | $64,700 | $68,850 | $73,010 | $77,182 | |

| 80% AMI | $58,450 | $66,800 | $75,150 | $83,450 | $90,150 | $96,850 | $103,500 | $110,200 | $116,816 | $123,491 | |

| 120% AMI | $87,720 | $100,200 | $112,680 | $125,160 | $135,240 | $145,200 | $155,280 | $165,240 | $175,224 | $185,237 | |

| 140% AMI | $102,340 | $116,900 | $131,460 | $146,020 | $157,780 | $169,400 | $181,160 | $192,780 | $204,428 | $216,110 | |

Who may I contact with additional questions?

If you have further questions, please contact our Assistance Center at 239-450-2114.

What can the financial aid be used for?

The funds or grants can be used for mortgage, rent and utility bills, so long as these expenses have not already been paid for by another assistance program (i.e., OUR Florida). Utilities that are a required term of the lease agreement such as water, sewer and trash may also be eligible according to the terms of the lease or rental agreement. Utilities covered by the landlord within the rent are treated as rent.

How far back can past due bills be paid?

Arrearage (past due bills) can be paid back to March 13, 2020. You must have been current on your rent, mortgage and/or utility accounts as of March 13, 2020. Arrearage and prospective payments are available up to the maximum of $25,000.

Am I required to be behind on my rent, mortgage or utility payments to qualify for these programs?

No. To apply for assistance under the ARP funds, you do not have to be currently behind on rent to quality.

I reside in subsidized housing. Do I qualify?

Depends on income. If you reside in subsidized housing, you can apply if your income does not exceed 140% AMI. See income chart below. If assistance is awarded, it will only be for the tenant portion of rent and utilities that is not paid by other rental assistance.

| County (Metro) | Income Category |

Income Limit by Number of Persons in Household | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||

| Collier County

(Naples-Immokalee-Marco Island MSA) Median: $104,300 |

30% AMI | $21,950 | $25,050 | $28,200 | $31,300 | $36,580 | $41,960 | $47,340 | $52,720 | Refer to HUD | Refer to HUD |

| 50% AMI | $36,550 | $41,750 | $46,950 | $52,150 | $56,350 | $60,500 | $64,700 | $68,850 | $73,010 | $77,182 | |

| 80% AMI | $58,450 | $66,800 | $75,150 | $83,450 | $90,150 | $96,850 | $103,500 | $110,200 | $116,816 | $123,491 | |

| 120% AMI | $87,720 | $100,200 | $112,680 | $125,160 | $135,240 | $145,200 | $155,280 | $165,240 | $175,224 | $185,237 | |

| 140% AMI | $102,340 | $116,900 | $131,460 | $146,020 | $157,780 | $169,400 | $181,160 | $192,780 | $204,428 | $216,110 | |

Can I apply over the phone?

No. You must apply thru the online application and upload required documentation to determine eligibility.

How do I know if I qualify and what documents do I need when I apply?

You must prove loss of income, *housing instability or other financial hardship occurred during or due directly or indirectly from the COVID-19 outbreak. Note: This does not mean an applicant had to contract the coronavirus.

Required Documentation:

- Verification of Unemployment filing since March 1, 2020, if applicable

- 2020 or 2021 or 2022 tax return, signed and dated

- A letter from employer verifying a reduction in hours, pay-rate, number of shifts, or business closure, if applicable

- Copies of pay stubs before and after COVID-19 outbreak, if applicable

- Other supporting documentation that proves your financial hardship, determined case-by-case

- Photo ID (government issued) for all persons in the household over the age of 18 * required

- US Citizenship for one adult household member

• Required citizenship documentation may include ONE of the following:- Birth Certificate

- Passport

- Naturalization Certificate

- Social Security Card

- Legal Resident Card

- Mortgage statement including coupon, if applicable

- Lease, if applicable

- Rental ledger, if applicable

- Collier County resident- REQUIRED

• Driver’s License or other government issued photo ID

• If ID has a different address, we need a copy of your utility bill showing your name and current - Application must be signed and dated by applicant and co-applicant (if applicable)

- Duplication of benefits certification must be signed and dated by applicant and co-applicant (if applicable)

- Release of information must be signed and dated by applicant and co-applicant (if applicable)

- Other documents that are necessary to process a complete application for assistance, such as housing instability documentation (past due utility bill, eviction notice, code report, inspection report, etc.)

*Housing instability is when one or more individuals within the household demonstrate a risk of experiencing homelessness or housing instability, which may include (i) a past due utility or rent notice or eviction notice, (ii) unsafe or unhealthy living conditions, or (iii) any other evidence of risk, as determined by the grantee.

What if the household has income, but there are members who do not have income?

In cases whereby the household does have an income, but there are individual household members who do not have an income, the household members without an income will be asked to check off the Self-Attestation Certification checkbox. (social security and pensions are income)

Self-Attestation Certification Checkboxes

- All Adult Household Members with Zero Income, Applicant Certifies that they have Zero Income.

- The Income and Calculated AMI% will show in the Income Portion of the Review/View on all screens

- These Certifications will Display in the Review and in the View on all screens where Applications are reviewed and/or viewed

Is there priority when applying?

Yes. Households are prioritized:

- With incomes at or below 50% AMI

- With one or more members who have been unemployed for more than 90 days, or

- Have evidence of housing instability/homelessness

Documentation is required to show the percentage of AMI, unemployment length, or proof of housing instability/homelessness.

There are two categories of applications that receive priority during the application process and are described below.

Impacted Households Presumed Eligible:

- Low-or-moderate income households or communities where income is at or below 65% of area median income (AMI) for Collier County

- Households that experienced unemployment

- Households that experienced increased food or housing insecurity

- Households that qualify for CHIP, childcare subsidies, CCDF or Medicaid

- Households that qualify for National Housing Trust Fund – for affordable housing programs

- Any student that lost access to in-person education – services to address lost instructional time in K-12

Disproportionately Impacted Households Presumed Eligible:

- Low-income households and communities where income is at or below 40% of area median income (AMI) for Collier County

- Households residing in Qualified Census Tracts (QCTs)

- CHS staff to verify and attest to address being in QCT

- Households that qualify for certain federal benefits (i.e., TANF, SNAP, SSI, WIC, Section 8 vouchers, LIHEAP)

- Households receiving services provided by Tribal governments

How is household income defined?

With respect to each household applying for assistance, the county will be using the U.S. Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

The ARP program will use the Federal Poverty Guidelines and the U.S. Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

How will the program determine my income for eligibility?

- Methods for Income Determination: Income eligibility will be determined by either (i) the household’s total income for calendar year 2021. A household’s monthly income to determine eligibility, will include a review of the monthly income information provided at the time of application and extrapolate over a 12-month period to determine whether household income exceeds 140% of area median income. For example, if the applicant provides income information for two months, the county will multiply it by six to determine the annual amount. If a household qualifies based on monthly income, the grantee must redetermine the household income eligibility every three months for the duration of assistance.

- Documentation of Income Determination: Household income must also include documentation available to support the determination of income, such as paystubs, W-2s or other wage statements, tax filings, bank statements demonstrating regular income, or an attestation from an employer.

- Assistance to Households Impacted or Disproportionately Impacted Households and Communities:US Treasury’s final rule presumes that certain populations were impacted and disproportionately impacted by the pandemic and are therefore eligible for services that are responding to the negative economic impacts of the pandemic.

What is the definition of Area Median Income?

The area median income (AMI) for a household is the same as the income limits for families published in accordance with 42 U.S.C. 1437a(b)(2), available under the heading for “Access Individual Median Family Income Areas”. This information is available at https://www.huduser.gov/portal/datasets/il.html. It is the midpoint of a region’s income distribution – half of families in a region earn more than the median and half earn less than the median.

Do I have to live in my rental unit for a set amount of time to be eligible?

No. Payments are provided to help households meet housing costs that they are unable to meet during or directly or indirectly related to the COVID-19 outbreak.

Is documentation information a matter of public record?

Yes. If public record requests are made regarding the ARP program, your application and documentation information will be subject to the public record process.

How long is the application review process?

The review process will take as long as necessary to review all documents. Applications will be returned to applicant or rejected if all required documents are not submitted. Processing could take up to 120 days. However, if all documents are received in a timely manner, the processing days could be significantly less. An application is not a guarantee of payment.

When will assistance be distributed?

Assistance requests will be processed as quickly as possible. Due to the widespread impact of the pandemic on our local community, we anticipate a high volume of requests. Payments will be disbursed as soon as possible. Applying does not mean funds will be disbursed. Your application will go through several review processes before it is approved and moved for payment.

Am I required to have a lease to be eligible for the program?

Yes. However, a landlord agreement or rental agreement may be substituted. Staff will help evaluate your documentation including the verified owner or management agent of the unit.

How will assistance be distributed?

Once your application is approved, payment will be made directly to the utility or mortgage company or landlord. The ARP online portal can be accessed here: Login (force.com). You will be notified of the status of your application via email.

Is there a maximum amount of assistance available per applicant?

The ARP program is limited to $25,000 per household.

Why wasn’t I approved or selected for a grant (assistance)?

In most cases, after a careful review of an application, we were unable to help because either the applicant did not meet mandatory eligibility requirements, or the application lacked information and/or appropriate documentation deemed necessary to confirm the applicant met all eligibility requirements was not provided.

What should I do if I received a notice that I was not approved or selected?

If you are denied assistance under the ARP program, you have the right to appeal this decision. You may send a written request for an appeal to: Tara.Bishop@colliercountyfl.gov.

I received communication that my application is still under review but is missing a piece of information. Is this valid and do I need to submit documentation?

Yes. If you fail to respond within the time provided, your case will be closed.

Who can I contact if I have problems applying or have a question?

To check on the status of your ARP application, click here. You may also visit our assistance center by appointment only located at Court Plaza, 2671 Airport Pulling Road South in Naples. Please call the Assistance Center at 239-450-2114 to setup an appointment Monday through Friday.

Will receiving this assistance disqualify me from other types of state or federal aid (i.e. unemployment) or OUR Florida?

No. You can still be eligible to receive unemployment or Federal stimulus funding. Please contact other funding agencies on eligibility for their programs. However, we cannot duplicate benefits from any agency issuing payments under the American Rescue Plan including OUR Florida.

If my application is denied, may I re-apply?

Yes. You may re-apply. If it is denied because the application is incomplete, please contact your processor and see if it can be re-opened before creating a duplicate application.

Can part-time residents apply for assistance?

Applicants must be full-time Collier County residents.

Can rent payments be made directly to tenants?

Yes. In these circumstances where a landlord is unwilling to participate in the program or provide documentation, the county may, at its discretion issue rental assistance directly to the tenant. If permitted, you are required to acknowledge use of funds for rent only and provide a certification of your understanding. Should you need assistance for additional months, a rent ledger showing applied payment must be provided to receive additional assistance.

Can payments be made to landlords after the tenant no longer resides in the unit due to owing back rent if qualified?

Yes. To remove barriers a household may face in accessing new housing, avoid further collection efforts and credit damage, as well as limit the financial burden on landlords, the County may, at the tenant’s request, aid with rental arrears after the eligible tenant has vacated a unit.

If I applied or received a forbearance with my mortgage lender, can I apply for assistance?

Yes. You can apply for assistance. Awarding a grant will depend on individual circumstances as described below.

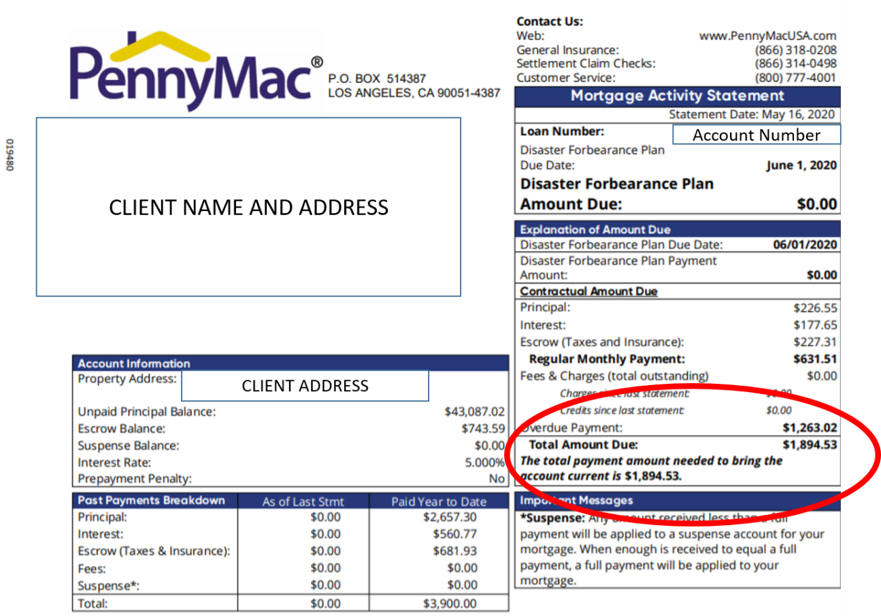

- Mortgage statements must show a balance due and a due date within the next 30 days. In the example below, the total amount due to bring the account current is $1,894.53. Although the “Amount Due” at the top of the statement indicates $0.00, the amount due to bring the account current may be paid, because this is essentially a past due balance. We may need to get additional clarification from the applicant if the statement is unclear.

My landlord is an individual, private person, not a business. Do I qualify?

You may qualify if you rent from a private landlord, if you have a signed lease or rental obligation. The lease must be a legally binding contract between the tenant and the landlord that details the rights and responsibilities of each party.

A lease or rental obligation typically includes the cost of the rental, the amount of deposit required, when rent is due, whether pets are allowed, and other rules or requirements under said agreement.

My landlord is not to whom I pay my rent, or I have a property management company. What do I need?

You must provide a current signed copy of the property management agreement between your landlord and the property management company.

I rent a single room occupancy unit and the property is not homesteaded. Do I qualify?

You may qualify if your housing meets the definition of a SRO: a residential property that includes multiple single room dwelling units. Each unit is for occupancy by a single eligible individual. The unit need not, but may, contain food preparation or sanitary facilities, or both.

I rent a room in the house of a private person and the property is homesteaded. Do I qualify?

In this case, you may qualify. Please discuss your lease with a CHS staff member by calling 239-450-2114.

I have an active recoupment with OUR FLORIDA. Do I qualify?

No. You do not qualify until you have resolved all recoupments with OUR FLORIDA as this may be a duplication of benefits. Collier County and OUR FLORIDA may not pay for the same months. Applicants are required to report duplication and any recoupment activities to the Collier County processor.

I have a private mortgage through an individual, not a mortgage company. Do I qualify for assistance?

In this case, you may qualify under the ARP mortgage assistance program. However, immediate family or relations by marriage cannot be the mortgage holder.

I operate a business from my home. Do I qualify for mortgage assistance, if I am past due?

You may qualify if you claim your home on your tax return. In this case, the portion deducted on your tax return will be reduced from the assistance payment requested. To validate the amount eligible, you will need to provide your most recent tax return.

How is the mortgage portion of the ARP program administered?

Those who apply for mortgage assistance will receive a notification after submitting your application. This notice will inform you to contact the Housing, Education and Lending Programs (HELP) for further assistance. HELP is a nonprofit agency collaborating with the county to manage the mortgage portion of the CCAP program. Your mortgage assistance application will be sent to them for processing and payment. To check on your application’s status, please reach out to them at 239-434-2397.

Am I required to participate in financial counseling?

Under the ARP mortgage program, all applicants must participate in financial counseling before any payments will be made.

I do not live in my home but rent it and the renter is late on payments. Does the renter qualify?

The renter (tenant) or the landlord can apply for assistance. Eligibility qualification depends on their circumstances and will need to meet eligibility outlined in above information. However, if the property is homesteaded and you are renting it out, the file will be denied. See “I rent a room in the house of a private person” question above.

Per Florida statutes 196.031 and 196.061, homesteaded properties may not be rented in their entirety or in part, unless there is a completely separate living quarters (apartment, in-law suite, etc.), whether attached to, or detached from the primary home. Any non-shared living space is eligible for rent, and payments should be provided to the landlord. Room rentals where there are shared common areas (kitchens, bathrooms, etc.), are not allowed.

How will I know the status of my application?

You can check the status of your application at any time by going to the application website. You will need the password used to register as well as your case number. Do not email staff directly as they will not respond. All questions must be submitted through your file in the system. Staff will respond to your inquiry through the online portal system.

What does the status on my file mean?

- Processors: This is your main point of contact. They are reviewing your application for eligibility and all documents. Processors will email you if there are any questions.

- Grant Coordinator: County staff validating all documents are in the file and the file is complete to move forward.

- Fiscal: The county’s fiscal staff are validating your file.

- Grant Management: Your file is under its final review with county staff.

- Approved: County staff have completed their review and your file has moved to the final stage of the review process.

I previously received assistance through the CollierCARES program. Can I re-apply for more assistance?

If you received assistance through CollierCARES, you may apply for assistance through ARP. Please visit our website at www.colliercountyhousing.com to access the website for your household needs.

Why does my file say “denied?”

A “denied” file means your file was reviewed and determined that you are not eligible for assistance. To file an appeal, please mail Tara.Bishop@colliercountyfl.gov.

My name on my ID isn’t the same as I go by now. What do I do?

You will be required to complete a same name affidavit and provide documentation like a birth certificate or divorce decree or official name change showing your name has changed. Per FS 322.19 (1) Whenever any person, after applying for or receiving a driver’s license, changes his or her legal name, that person must within 10 days thereafter obtain a replacement license that reflects the change.

My address on my ID doesn’t match my address on the mortgage or lease. What do I do?

You will be required to provide a pay stub, bank account or utility bill showing your name and address as reflected in your lease or mortgage statement. Per FS 322.19(2) Whenever any person, after applying for or receiving a driver’s license, changes the residence or mailing address in the application or license, the person must, within 10 calendar days, obtain a replacement license that reflects the change.

Can I apply for relocation expenses, like first, last and security deposit?

Yes. Depending on availability of funding, Applicants may be assisted with relocation expenses, which may include deposits, first and last month, application and screening fees. Applicants requesting relocation expenses must meet the eligibility criteria for the program. A lease for the new unit is required. The landlord will be required to submit a W-9.

What if my landlord resides outside of the United States and cannot provide a W9?

Provide your landlord a W8 form, which is for non-U.S. Citizens who own property or for those landlords that reside outside the U.S. You can download the form here: W8 FORM.

My landlord will not provide a ledger or W-9. Will you contact my landlord?

Collier County staff will not call or email your landlord. As the applicant, you are required to gather all documentation to support your application.

Additional forms.

The following are forms that you may be required to fill out if requested. Once completed, upload them into your file through the portal under the TASK option.

What is the EHEAP program?

The Emergency Home Energy Assistance Program (EHEAP) is available to households who have a delinquent electric bill and an adult 60 years or older who resides in the home. EHEAP can also assist with the repair and replacement of air conditioning to an elderly household who is a homeowner.

Who can Apply?

Any household can apply that has an adult 60 years or older that resides in the home and the electric bill is past due, has a Shut Off Notification or electricity is currently shut off. The delinquent amount is paid directly to the electric utility company.

How do I apply?

You can apply in-person at the Collier County Community and Human Services Office located at 3339 Tamiami Trail E Suite 211, in Naples. For more information, call (239) 252-CARE (2273) or dial 311.

How far back can bills be paid?

Any past due bills are eligible. ONLY the past due or delinquent amount of the electric bill can be paid. If the service has been disconnected, all delinquent charges and late fees are eligible for payment as well as deposits for reconnection of the electric service. Returned check fees are not eligible.

Do I qualify if I reside in subsidized housing?

Please read your lease agreement and see if a utility subsidy is provided to you. If you do not receive a subsidy, you may apply for assistance. If you receive a utility subsidy, you may not qualify for assistance.

What documentation do I need?

- FPL or LCEC Electric Bill

- Social Security cards for all members in the household

- State of Florida issued photo ID’s for all adults in the household

- Proof of Income for all members living in the household-18 years or older

- Social Security, SNAP or TANF award letters

- Mortgage or lease agreement

How is household income defined?

We follow the 150% Federal Poverty Limits (FPL) guidelines, but if someone in the household receives Social Security, SNAP or TANF benefits, there are no income guidelines; provided there is a member residing in the household who is 60 years or older.

Is there a maximum amount of assistance?

You may be eligible for assistance for every monthly past due electric bill and/or air conditioner repair/replacement up to $5,000 total per year.

What do I do if my application is not accepted?

You may call 311 for information about other Collier County social services’ agencies that may provide you with past due utility assistance.

Who do I call if I need my air conditioning repaired?

This applies to homeowners only. Please call the Community & Human Services Main number at 239-252-2273 for help.

How do I get a new HVAC if needed?

You must be a homeowner to receive assistance for a new HVAC. The maximum benefit amount is $5,000. Documentation you will need includes:

- Three air conditioning estimates

- If the HVAC exceeds $5,000, you will need documentation for how the remaining amount will be paid in full

- Proof of income for all members living in the household that are 18 years or older

- Social Security cards for all members in the household

- State of Florida issued photo ID’s for all adults in the household

- Social Security, SNAP or TANF award letters

- Mortgage information

- Proof of homestead status

What is the ESG RUSH Program?

Rapid Unsheltered Survivor Housing under the ESG Program (RUSH) is a Special allocation of Emergency Solutions Grants (ESG) funding to 8 recipients in Florida. It is focused on equity and serving households who have been systematically discriminated against in other aspects of disaster recovery. It comes in two versions, Rapid Re-Housing (*RRH*) for those who are literally Homeless and Homelessness Prevention (*HP*) which is for those who are about to become homeless. For ESG RUSH, the Fair Market Rent is waived but there MUST be a Hurricane Ian Impact. For what is called Annual ESG, the Fair Market Rent is not waived but there does NOT have to be a Hurricane Ian Impact.

Who is the program specifically designed for? How is this defined?

Individuals or family who lack a fixed, regular, and adequate nighttime residence are the focus recipients for this program. This might mean you have a primary residence that is public or private and not meant for human habitation OR a publicly or privately operated shelter designated to provide temporary living arrangements OR you are exiting an institution where you have resided for 90 days or less.

Who is eligible for assistance?

Those eligible for assistance must be homeless or at risk of homelessness, have been residing in Collier County in an area affected by Hurricane Ian, and have needs that will not be served or fully met by Transitional Sheltering Assistance (TSA).

What can the program funds be used for?

The RUSH program is designed to assist Collier County residents with rental and utility assistance including security and utility deposits, last month’s rent, application fees, moving costs, relocation costs, and supportive services such as housing search and placement, case management.

Do I have to repay ESG Rush funds?

No. The ESG RUSH funds do not have to be paid back. However, funds distribution is reported to the IRS for landlords.

Who can apply?

People who were literally homeless prior to the disaster, people who have become literally homeless as a result of the disaster AND were forced to leave the place they were staying because of the Hurricane. You may also apply if you are at risk of homelessness as a result of the disaster within the next 21 days. An annual area median income (AMI) level at 30% or below is required (see chart below).

How do I apply?

You can apply online at CollierCountyHousing.com or by scheduling an appointment at our office located in Court Plaza at 2671 Airport Pulling Road South, Suite 203, Naples, FL 34112. To schedule an in-person appointment, please call (239) 450-2114. If applying online, please remember to save your password and case number in a secure location. You will need this information to come back and check your status.

The link for the ESG RUSH application is https://colliercountyflgovgrants.my.site.com/recovery/s.

Can part time residents apply for assistance?

No. Applicants must be full time Collier County residents.

How can I confirm that I qualify?

To certify homeless status, you must provide written observation by an outreach worker, written referral by another housing or service provider OR certification by you or head of household seeking assistance stating that you were living in the streets or in a shelter.

I received assistance from TSA (FEMA Temporary Shelter Assistance) but it has ended. Can I still apply for this program?

Yes. You can apply if you have utilized TSA and those services have ended.

Do I need to have applied to FEMA in order to apply for RUSH funds?

In some instances, YES, you will need to provide evidence that you have applied to FEMA and provide the decision letter. This will be determined on a case by case basis.

Am I required to be behind on my rent or utility payments to qualify for this program?

No. To apply for assistance under this program, you do not have to be currently behind on rent.

Do I have to live in my rental unit a set amount of time to be eligible?

No. Payments are provided to help households meet housing costs that they are unable to meet because of the disaster. Must have a lease that is at least 6 months long.

Is documentation information a matter of public record?

Yes. If public record requests are made regarding the ESG RUSH, your application documentation information will be subject to the public record process.

How will assistance be distributed?

The funds are being distributed based on a HUD defined priority basis as shown in the chart below.

| A) Disaster Impacted County | 1a) People who were literally homeless Prior to the disaster 1b) People who have become literally homeless as a result of the disaster AND 2) Were forced to leave the place they were Staying because of the Hurricane. 3) Not TSA eligible. |

UNSHELTERED | -Unaccompanied Youth -Family with Minor Children -Adult |

| SHELTERED | -Unaccompanied Youth -Family with Minor Children -Adult |

||

| B) Disaster Impacted County | 1) People who have utilized TSA and those services have ended 2) At risk of homelessness or literally Homeless as a result of the disaster 3) Were forced to leave the place they were Staying because of the Hurricane |

SHELTERED | -Unaccompanied Youth -Family with Minor Children -Adult |

How is household income defined?

With respect to each household applying for assistance, the county will be using the U.S. Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using adjusted gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

What are the income restrictions for this program?

The income guidelines are provided in the chart below.

| FY 2024 Income Limit Area | Median Family Income | FY 2024 Income Limit Category | Persons in Family | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |||

| Naples-Immokalee-Marco Island, FL MSA | $104,300 | Extremely Low Income Limits ($)* | 21,950 | 25,050 | 28,200 | 31,300 | 36,580 | 41,960 | 47,340 | 52,720 |

Is there a maximum period of assistance available per applicant?

You may be eligible for up to 24 months of rental assistance, based on funding availability. NOTE: Funds are limited and at any time rental assistance can be discontinued.

Is there a maximum amount of assistance I can receive?

The maximum amount of assistance is based on your income and the amount of rent you are paying. The purpose of the program is assistance in an affordable rental unit that will be sustainable once assistance ends.

What documentation will be needed for my application?

A complete application will include, at minimum, the following:

- Application: Must be completed by Head of Household

- Same Name Affidavit

- Lease Agreement, signed and dated by all parties – include all pages

- Landlord Ledger showing payment history

- Proof of US Citizenship or Legal Residency for applicant or documentation of eligible non-citizen

- Proof of Collier County Residency

- Eviction Notice, 3-day notice or 21 -day notice or 30-day notice, if applicable

- Condemnation Notice (if applicable)

- Homeless Documentation from Social Service agency – must include date of homelessness and current situation, if applicable

- Release of Information form: For all household members 18 years of age or older

- Government issued Picture ID: For all household members 18 years of age or older

- Social Security Card: For all household members 18 years of age or older

- Benefit letter(s): Includes Social Security, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), Veterans, Long-term Disability, Unemployment determination (1099 forms are not acceptable), if applicable

- Income:

- 2022 and/or 20231 Tax Returns; or two months of pay stubs

- If self-employed, must provide the last two years of tax returns along with a year-to-date profit and loss statement

- One month of current bank statement for all accounts (Checking, Savings, Money Market), (include ALL pages)

- Most recent quarterly statement for 401k, pension, IRA/Investment account, etc. (Include all pages)

- Notice for Collection of Social Security Numbers form

- Proof of Federal Emergency Management Agency (FEMA) application filing and result, if applicable

- Duplication of Disaster Benefits Affidavit – Signed and Dated

- Intake Form

What if I don’t have any tax returns?

If you cannot provide tax returns, and they are required for income verification, you may provide one (1) month of pay stubs. Transcripts are also available from the IRS.

What if I am receiving other assistance benefits?

If you are receiving benefits from other sources, you will be required to provide that information. Your processor will determine your eligibility based on that information.

Do I need to be concerned with Duplication of Benefits when applying for these funds?

Each adult household member/owner must sign the DOB (Duplication of benefits) affidavit form. If you received assistance from FEMA, another social service agency or other state or local program for rental assistance you may not be eligible.

Who is the rental assistance paid to?

Rental assistance is paid directly to the landlord.

My landlord is an individual, not a commercial business. Do I qualify?

You may qualify if you rent from a private landlord and have a signed lease or rental obligation. The lease must be a legally binding contract between the tenant and that landlord that details the rights and responsibilities of each party and at least 6 months in duration. A lease or rental obligation typically includes the cost of the rental, the amount of deposit required, when rent is due, whether pets are allowed, and other rules or requirements under said agreement.

Does the landlord know that I am receiving assistance?

Yes. The landlord will be signing an agreement with the County. They will agree to specific terms with the County and agree to receive a portion or the full amount of the rent from the County.

Do I need to recertify my income every three months?

Yes. Your income will need to be recertified every three months.

Does the county have to inspect the apartment before I can move in?

Yes. A ‘habitability study’ will be conducted prior to move in by a county staff member.

Can rent be paid directly to the tenants?

No. Payments may be made only to landlords.

What if my landlord resides outside of the United States and cannot provide a W-9?

Provide your landlord with a W-8 form, which is for non-US Citizens who own property or for those landlords that reside outside the US. The rent checks may need to be made to the tenant in this case, and you will need to pay the landlord.

I received communication that my application is still under review but missing a piece of information. Is it valid and do I need to submit documentation?

Yes. This is a valid email. Please return whatever information is being requested. If you have questions, email or call your processor that sent you the email. You have a limited amount of time to provide missing information before your application is closed.

How long is the application process?

The review process will take as long as necessary to review all documents. Incomplete applications will take significantly longer. Processing could take up to 120 days, however, if all documents are received in a timely manner, the processing days could be significantly less. Once your application is approved, payment will be made directly to the landlord. You may check the status of your application in the portal.

What does the status on my file mean?

- Processors: This is your main point of contact. They are reviewing your application for eligibility and all documents. Processors will email you if there are any questions.

- Fiscal: The county’s fiscal staff are validating your file for fiscal components.

- Management Review: Your file is under its final review with county staff.

- Approved County: County staff have completed their review and your file has moved to the final stage of the review process.

- Pending Clerk Payment: Your file is under review for payment with the Clerk of Courts.

- Clerk Payment: The Clerk of Courts has issued payment to your landlord.

Why wasn’t I approved or selected for assistance?

Denial letters will list the reasons. In general a denial is due to not meeting mandatory eligibility requirements, or the application lacked information and/or appropriate documentation deemed necessary to confirm the applicant met all eligibility requirements.

What should I do if I received a notice that I was not approved or selected?

If you are denied assistance under the RUSH program, you have the right to appeal this decision. You may send a written request for an appeal to tara.bishop@colliercountyfl.gov.

If my application is denied can I reapply?

Yes. You can reapply. However, if your application is denied and you met all eligibility criteria, it is most likely your application is not complete, and you will be notified to submit the information required for completion.

Who can apply?

Individuals and families that have been directly impacted by Hurricane Ian. A directly impacted applicant could be a homeowner or renter that experienced damage to their residential property. Applicants might also have been displaced, but that is not a requirement to apply.

How do I document a Hurricane Ian direct financial impact?

The ways a household can document being directly impacted include being a recipient of other housing-related disaster benefits and receipts for hotel stays, if displaced. Financial impacts include loss of employment or a flooded car that can be documented directly to Hurricane Ian.

When can I apply?

The State Housing Initiatives Partnership (SHIP) Hurricane Rental Program applications will be accepted starting at 12 p.m. on May 17, 2023.

How do I apply?

You must apply online at CollierCountyHousing.com and create an account. Please remember to save your password and case number in a secure location. You will need this login information to come back and check your status. If you have any question or need help, call our office (239) 450-2114. The office is located at 13245 Tamiami Trail East, Suite 102, Naples, FL 34114. We do not process applications over the phone and no walk ins will be accepted.

What can the financial aid be used for?

The grant funds can be used for rent, so long as these expenses have not already been paid for by another local, state, federal, or private organization’s assistance program. Utilities that are required by the terms of the lease or rental agreement such as water, sewer and trash may also be eligible. Telecommunication services such as cable, telephone and internet are not eligible. Utilities covered by the landlord within the rent are treated as rent.

Can I apply for utilities only?

No. However, utilities covered by the landlord within the rent are treated as rent.

How far back can past due rent be paid?

The State Housing Initiatives Partnership (SHIP) Hurricane Rental Program may pay past due rent up to September 28, 2022, but a maximum assistance of $20,000 per applicant.

Am I required to be behind on my rent to qualify for these programs?

No. To apply for assistance under Collier County SHIP Hurricane Rental Program, you do not have to be currently behind on rent to quality for this aid.

How do I know if I qualify based on income?

The household annual income cannot exceed 120% of the area median income (AMI) as listed in the table below. The AMI for a household is the same as the income limits for families published in accordance with 42U.S.C. 1437a(b)(2), available under the heading for “Access Individual Median Family Income Areas.” This information is available at https://www.huduser.gov/portal/datasets/il.html.

| County (Metro) | Income Category |

Income Limit by Number of Persons in Household | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||

| Collier County

(Naples-Immokalee-Marco Island MSA) Median: $104,300 |

30% AMI | $21,950 | $25,050 | $28,200 | $31,300 | $36,580 | $41,960 | $47,340 | $52,720 | Refer to HUD | Refer to HUD |

| 50% AMI | $36,550 | $41,750 | $46,950 | $52,150 | $56,350 | $60,500 | $64,700 | $68,850 | $73,010 | $77,182 | |

| 80% AMI | $58,450 | $66,800 | $75,150 | $83,450 | $90,150 | $96,850 | $103,500 | $110,200 | $116,816 | $123,491 | |

| 120% AMI | $87,720 | $100,200 | $112,680 | $125,160 | $135,240 | $145,200 | $155,280 | $165,240 | $175,224 | $185,237 | |

| 140% AMI | $102,340 | $116,900 | $131,460 | $146,020 | $157,780 | $169,400 | $181,160 | $192,780 | $204,428 | $216,110 | |

- Must be a Collier County resident, with proof of residency as evidenced by a government issued ID (driver’s license); and

- The household must have a direct housing or financial impact from Hurricane Ian; and

- Have been residing in Collier County at the time that Hurricane Ian came onshore, September 28, 2022; and

- Have needs that will not be served or fully met by the FEMA Temporary Shelter Assistance Program; and

- All applicants must be 18 years of age or above and must be a legal U.S. resident or eligible non-citizen. Required documentation includes ONE of the following per household member:

- Social security card

- Birth certificate

- Passport

- Naturalization certificate

- Green card or permanent resident card

What other documentation will I need to apply?

- Complete copy of signed lease and all addendums and extensions.

- Rent ledger from landlord.

- Landlord’s W-9.

- Six months bank statements for ALL accounts for all household members.

- Two months’ pay stubs for all household members over the age of 18.

- Most recent quarterly statement for 401k, pension, IRA or other investment account, etc. (Include ALL pages)

- Application must be signed and dated by applicant and co-applicant (if applicable) and all household members over the age of 18.

- Duplication of benefits certification must be signed and dated by applicant and co-applicant (if applicable).

- Release of information must be signed and dated by applicant and co-applicant (if applicable).

- Same Name Affidavit form must be signed and notarized for all household members over the age of 18.

- Social security card for each household member over the age of 18 years old.

- Benefit letter (s): Including Social Security Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), Veterans’ benefits, long-term disability, unemployment determination (1099 forms are not acceptable).

- Notice for Collection of Social Security Numbers form signed and dated by all adult household members.

- Proof of FEMA application filing and results.

- Signed and dated State Housing Initiatives Partnership program (SHIP) Disaster Assistance written agreement.

- Condemnation notice, if applicable.

- Homeowners, renters, or car insurance documentation (if applicable).

- Copy of unemployment or layoff letter stating employment change is due to Hurricane Ian.

- Other documents as requested that are necessary to completely process an application for assistance.

How is household income defined?

With respect to each household applying for assistance, the county will be using the U.S. Department of Housing and Urban Development’s (HUD) definition of “annual income” in 24 CFR 5.609 and using gross income as defined for purposes of reporting under Internal Revenue Service Form 1040 series for individual federal annual income tax purposes.

How will the program determine my income for eligibility?

ALL Income must be reported for ALL adult household members. All applicable supporting documentation must be supplied including:

- Two months of pay stubs or,

- If self-employed, must provide the last two years of tax returns along with a six-month profit and loss statement; and

- Six months of current bank statement for all accounts (checking, savings, money market), (include ALL pages); and

- Most recent quarterly statement for 401k, pension, IRA/Investment account, etc. (Include ALL pages)

Do I qualify if I live in subsidized housing?

If you reside in subsidized housing, you may apply for the Collier County SHIP Hurricane Rental Program, which may provide rental assistance. However, it will only be for the tenant portion of rent that is not paid by other rental assistance. In addition, it is dependent on the subsidy received. Utilities that are required by the terms of the lease or rental agreement such as water, sewer and trash may also be eligible. Telecommunication services such as cable, telephone and internet are not eligible. Utilities covered by the landlord within the rent are treated as rent.

Do I have to live in my rental unit for a set amount of time to be eligible?

No. Payments are provided to help households meet housing costs because of Hurricane Ian.

Is documentation information a matter of public record?

Yes. If a public record request is submitted regarding the SHIP Hurricane Rental Program, your application and documentation information will be subject to the public record process. However, various types of records are considered exempt and/or confidential and therefore, not available through a public records request. Certain statutory exemptions are contained throughout Florida Statutes. Specifically, Florida Statutes Section 119.071 defines which records are exempt from inspection or copying and contains some commonly cited exemptions. To view these exemptions, please visit www.leg.state.fl.us/statutes.

How long is the application review process?

The review process will take as long as necessary to review all documents. Incomplete applications will take significantly longer and may be moved to the bottom of the priority list. Processing could take up to 120 days. However, if all documents are received in a timely manner, the processing days could be significantly less.

When will assistance be distributed?

Assistance requests will be processed as quickly as possible. Payments will be disbursed as soon as possible to the landlord.

Am I required to have a lease to be eligible for the program?

Yes. You must have a lease.

What are the “other expenses” allowed through the SHIP Hurricane Rental Program?

Other expenses include application fees, move-in fees, and relocation costs such as first, last and security deposits. All payments for housing-related expenses must be supported by a ledger, bill or invoice. Moving and movers’ expenses are not allowed. Security deposits paid by the county must be returned to the county if the tenant does not complete a minimum of six months of the lease.

How will assistance be distributed?

Once your application is approved, payment will be made directly to the landlord. The online portal used for the SHIP Hurricane Rental Program will notify you of the status of your application.

Is there a maximum amount of assistance available per applicant?

The county can only pay up to the maximum award amount of $20,000 per applicant. Funding is available on a first-come, first-qualify basis until funds are exhausted. Only complete applications submitted with all required documentation will be considered.

Why wasn’t I approved or selected for a grant (assistance)?

In most cases, after a careful review of an application, we were unable to help because either the applicant did not meet mandatory eligibility requirements, or the application lacked information and/or appropriate documentation deemed necessary to confirm the applicant met all eligibility requirements.

Will I receive communication that my application is still under review but is missing a piece of information?

Yes. If you received this communication, you have currently not been approved for funding because your application is missing information. As a result, you have been identified as an applicant who will be provided with a limited amount of time to provide the missing information, or, in some instances, it will be an item your landlord needs to provide. Missing information should be returned promptly by the deadline given in your notification or your case may be closed.

Who can I contact if I have problems applying or have a question?

You may check on the status of your Statewide Housing Initiative Partnership (SHIP) Hurricane Rental Program application online. You may also visit the assistance center by appointment located at 13245 Tamiami Trail, Suite 102 in Naples, beginning May 17. Please call the Assistance Center at (239) 450-2114 to set up an appointment Monday through Friday, 8 a.m. to 5 p.m. Walk-ins are not accepted.

Will receiving this assistance disqualify me from other types of state or federal aid (i.e. unemployment)?

No. You can still be eligible to receive unemployment, but you may not receive FEMA TSA assistance. Please contact other funding agencies on eligibility for their programs.

Can I reapply if my application is denied?

No. You cannot re-apply. However, you may appeal the decision. If you want to file an appeal, please email Tara.Bishop@colliercountyfl.gov within five business days of receipt of your denial email. Please state in your appeal request the reasons you feel this determination should be reconsidered and attach any information that you feel should be considered that would make you eligible for the program.

Can part-time residents apply for assistance?

No. Applicants must be full-time Collier County residents at the time of the hurricane and presently.

How is SHIP Disaster Recovery Assistance funded?

Disaster assistance aids households in incorporated or unincorporated Collier County in the aftermath of a disaster as declared by the president of the United States or governor of the State of Florida. This strategy will only be funded and implemented in the event of a disaster using any fund that has not yet been encumbered or with additional disaster funds allocated by the Florida Housing Finance Corporation. SHIP Disaster Recovery funds may be used for items such as, but not limited to, residents that have been displaced from their homes due to a disaster and need assistance paying for housing costs such as security deposits, temporary rent, and relocation. Maximum assistance benefit per qualified applicant is $20,000.

Is funding first-come, first-served?

Funding is allocated on a first-come, first-qualified basis to those who meet the eligibility criteria, meet state mandated income level priorities and submit completed documents for approval. Financial assistance will be given to qualified applicants until relief funds are exhausted. Priority is given to applicants qualifying as special needs households and households with income levels below 50% AMI. Then, funds will be allocated to qualified applicants with income levels between 50.01% and 80% AMI, and if funds remain available, disbursements will be made to applicants with household income levels up to the maximum 120% AMI. Funding between more than 80% and 120% AMI is extremely limited.

Do I qualify if my landlord is an individual, not a commercial business?

You may qualify if you rent from a private landlord and have a signed lease. The lease must be a legally binding contract between the tenant and the landlord that details the rights and responsibilities of each party. A lease typically includes the cost of the rental, the amount of deposit required, when rent is due, whether pets are allowed, and other rules or requirements under said lease.

Do I qualify if I rent a home that has a homestead exemption granted by the Collier County Property Appraiser?

No, homestead properties may not be rented.

Do I qualify if I rent a room in the house of a private person who also lives on the property, and it is homesteaded?

In this case, you may qualify. Any non-shared living space is eligible for rent, and payments should be provided to the landlord. You must have your own bedroom and bathroom.

How will I know the status of my application?

You can check the status of your application at any time by going to the application website for the SHIP Hurricane Rental Program. You will need the password used to register as well as your case number.

What does the status on my file mean?

- Processors: This is your main point of contact. They are reviewing your application for eligibility and all documents. Processors will email you if there are any questions.

- Fiscal: The county’s fiscal staff is validating your file for fiscal components.

- Management Review: Your file is under its final review with county staff.

- Approved County: County staff have completed their review and your file has moved to the final stage of the review process.

- Pending Clerk Payment: Your file is under review for payment with the Clerk of Courts.

- Clerk Payment: The Clerk of Courts has issued payment to your landlord or utility company.

What does it mean when I log into the online application and it says “this email already exists”?

If you receive the message, “This email already exists,” when you try to login to the online application, it means you have previously created an application and will need to set up a new account.

Why does my file say “denied?”

A “denied” file means your file was reviewed and determined that you are not eligible for assistance through the SHIP Hurricane Rental Program. If you want to file an appeal, please email Tara.Bishop@colliercountyfl.gov within five business days of receipt of your denial email. Please state in your appeal request the reasons you feel this determination should be reconsidered and attach any information that you feel should be considered that would make you eligible for the program.

Do I qualify if I own a home and I am displaced due to repairs?

Yes. You may qualify if you meet all program eligibility requirements. The program will not pay your mortgage payment, repairs, HOA fees or taxes but will assist you with your rental payment until such time as you return home or reach the $20,000 threshold.

FAQs are not intended to include all program rules.